Our Schools. Our Future. Vote YES on November 4, 2025

Supplemental Levy FAQ's

On July 31, 2025, the BISD board of directors passed a resolution requesting a Supplemental Enrichment & Operations Levy over the next three years, in the following total amounts:

Why can BISD go out for a supplemental levy?

Washington state lawmakers have, for the first time since the 1970s, allowed Bainbridge Island School District to seek a one-time increase of $500 per student beyond the levy lid. This unique opportunity was created to help address the ongoing gap between what the state funds and what it actually costs to provide a high-quality education in our community. Passing a supplemental levy allows BISD to continue supporting essential staff and programs that would otherwise remain underfunded by the state.

By supporting BISD schools, does it affect my home value?

Yes. Strong public schools often help support property values. According to the National Association of Realtors, “the quality of public schools influences where people buy a home and what they pay for it.” Also, research by the National Bureau of Economic Research showed that every additional $1 spent on public schools could raise home values by about $20.

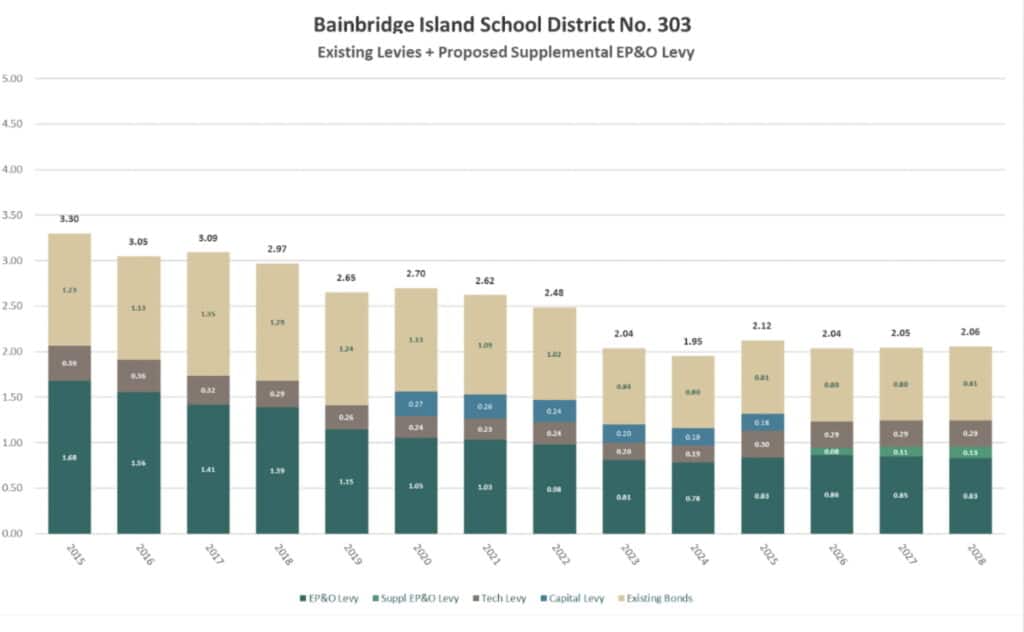

Am I paying more than I did ten years ago?

Over the last decade, the portion of your property taxes that goes to schools has actually gone down. Even though home values may have gone up, state law puts limits on how much school districts can collect through local levies. At the same time, the state increased its share of school funding after the McCleary decision. This means that compared to ten years ago, a smaller percentage of your overall property tax bill goes to support local schools.Yes. Strong public schools often help support property values. According to the National Association of Realtors, “the quality of public schools influences where people buy a home and what they pay for it.” Also, research by the National Bureau of Economic Research showed that every additional $1 spent on public schools could raise home values by about $20.

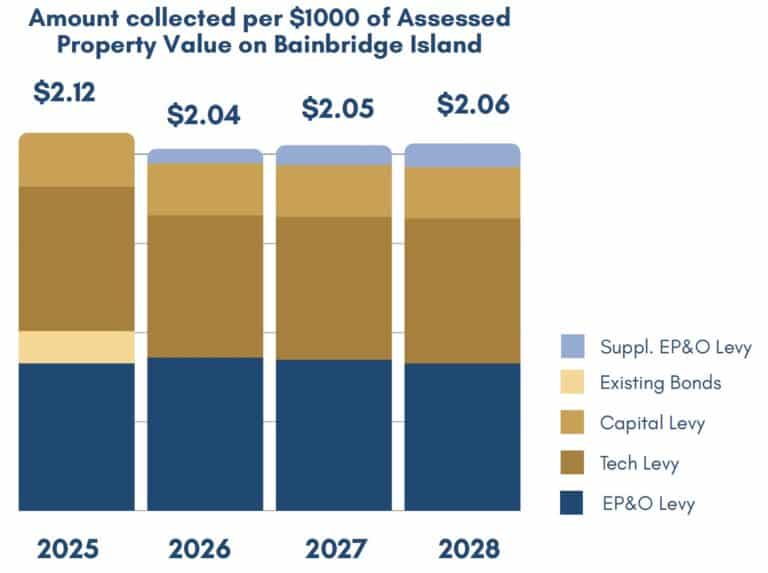

How does that translate to tax rates?

Year | Enrichment & Operations | Levy Amount |

|---|---|---|

2026 | $0.08 | $1,103,828 |

2027 | $0.11 | $1,572,896 |

2028 | $0.13 | $2,002,902 |

What will it pay for?

The dollars raised will provide financial stability by moving from a difficult financial position to a now balanced budget, ensuring responsible use of resources.

It will sustain strong programs that support every student.

It will restore and strengthen programs in curriculum, student services, and enrichment that have been stretched thin.

What will it cost?

What will it cost? Even with the addition of this supplemental levy, the overall school tax bill for Bainbridge taxpayers is going down due to expiring bond taxes.

Where your dollars are going

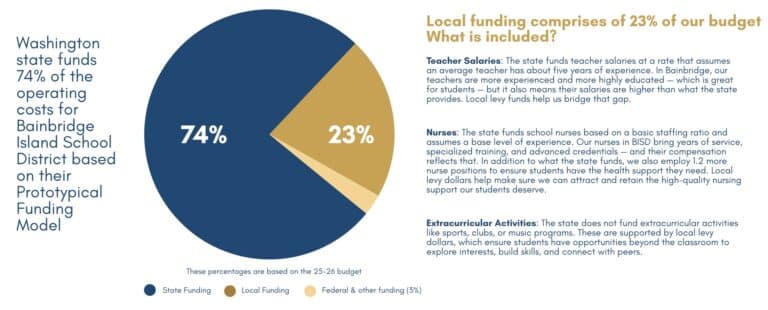

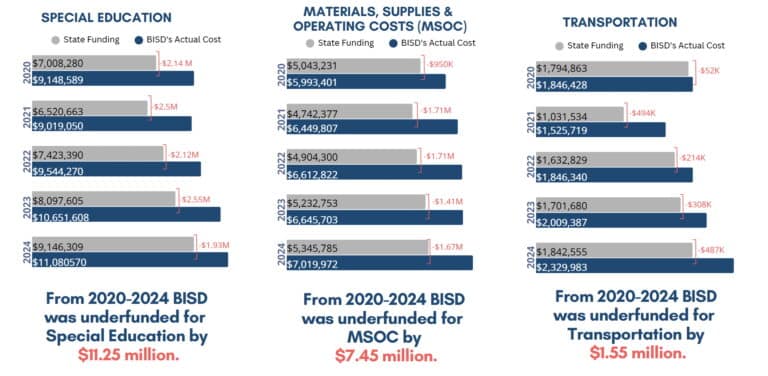

Since 2020, BISD has been underfunded by more than $20 million in key operating areas—including teacher salaries, special education, transportation, and materials/supplies—requiring local levy dollars to bridge the gap.

Understanding the funding gap

State funding covers only the basic education requirements defined by law, leaving significant shortfalls in critical areas. Look at the categories below — Special Education, MSOC (Materials, Supplies & Operating Costs), and Transportation — where the state drastically underfunds public education. The difference between what the state provides and what our community values creates a funding gap. Local levy dollars fill that gap, ensuring students have access to the well-rounded education and support they need to thrive.UNDERSTANDING THE FUNDING GAP State funding covers only the basic education requirements defined by law, leaving significant shortfalls in critical areas. Look at the categories below — Special Education, MSOC (Materials, Supplies & Operating Costs), and Transportation — where the state drastically underfunds public education. The difference between what the state provides and what our community values creates a funding gap. Local levy dollars fill that gap, ensuring students have access to the well-rounded education and support they need to thrive.Since 2020, BISD has been underfunded by more than $20 million in key operating areas—including teacher salaries, special education, transportation, and materials/supplies—requiring local levy dollars to bridge the gap.

Does the school district collect all of this money every year?

Not always. When the legislature enacted the “McCleary fix” they set limits on how much local districts could collect for enrichment levies. The limit is the lesser of either $2.50 per $1000 AV or $2,500 per student. BISD qualifies for the latter and only collects $2,500 per student. As enrollment fluctuates, so does the amount the district can collect.

The amount requested is the maximum that can be collected. It can never be more, and it could be less.

Where can I find the full texts of the resolutions?

You can find them here.

When do we vote on this?

The Kitsap County Auditor will mail ballots to voters in late October (approximately Oct. 17, 2025). Completed ballots must be either:

1. Dropped at a polling location or ballot drop box before 8 pm on November 4, 2025

or;

2. Returned by mail in the postage-paid, supplied envelope postmarked by November 4. Please note that a stamp is NOT required.

What if I’m not registered to vote?

For more information on registering to vote in Kitsap County go here.