Our Schools. Our Future. Vote YES on November 4, 2025

Proposition 1: Supplemental Levy

BAINBRIDGE ISLAND SCHOOL DISTRICT #303

KITSAP COUNTY, WASHINGTON

SUPPLEMENTAL ENRICHMENT AND OPERATIONS LEVY RENEWAL

RESOLUTION NO. 10-24-25

A RESOLUTION of the Board of Directors of Bainbridge Island School District No. 303, Kitsap County, Washington, providing for the submission to the qualified electors of the District at a special election to be held therein on November 4, 2025, of the proposition of whether supplemental excess taxes should be levied of $1,103,828 in 2025 for collection in 2026, $1,572,896 in 2026 for collection in 2027, and $2,002,902 in 2027 for collection in 2028, said excess taxes to pay part of the costs of educational enrichment programs and operations support of the District.

ADOPTED JULY 31, 2025

PREPARED BY:

PACIFICA LAW GROUP LLP

Seattle, Washington

RESOLUTION NO. 10-24-25

A RESOLUTION of the Board of Directors of Bainbridge Island School District No. 303, Kitsap County, Washington, providing for the submission to the qualified electors of the District at a special election to be held therein on November 4, 2025, of the proposition of whether supplemental excess taxes should be levied of $1,103,828 in 2025 for collection in 2026, $1,572,896 in 2026 for collection in 2027, and $2,002,902 in 2027 for collection in 2028, said excess taxes to pay part of the costs of educational enrichment programs and operations support of the District.

WHEREAS, Bainbridge Island School District No. 303, Kitsap County, Washington (the “District”), is a first-class school district duly organized and existing under and by virtue of the Constitution and the laws of the State of Washington (the “State”) now in effect; and

WHEREAS, pursuant to RCW 84.52.053, the qualified electors of the District may by a simple majority vote authorize an enrichment levy of up to four years to support the District’s educational programs and operations; and

WHEREAS, pursuant to RCW 84.52.053(2)(a), school districts are prohibited from authorizing additional tax levies for enrichment funding, except for additional levies to provide for subsequently enacted increases that affect the district’s maximum levy; and

WHEREAS, the voters of the District approved a four-year enrichment and operations levy at the February 13, 2024 election; and

WHEREAS, at the time of the levy’s adoption, the maximum levy amount available to the District was $2,500 per pupil, adjusted for inflation using the consumer price index for all urban consumers, Seattle area (“Seattle CPI”), pursuant to RCW 84.52.0531; and

WHEREAS, in 2025, the State Legislature passed Engrossed Substitute House Bill 2049

(“ESHB 2049”), which increased the maximum enrichment levy amount for certain school districts (including the District) by, among other things, increasing the maximum per-pupil limit by $500 in 2026, and increasing the maximum per-pupil limit by 3.3 percent above Seattle CPI each year from 2027 to 2030; and

WHEREAS, ESHB 2049 increases the maximum amount of enrichment funding the District may levy, and thereby enables the District to seek voter approval to supplement its current levy, which the District adopted prior to ESHB 2049’s enactment; and

WHEREAS, funds available in the District’s General Fund, including sub-funds thereof, during the school years of 2025–2026 through 2028–2029, will be insufficient to pay for necessary educational programs and operations and properly meet the educational and safety needs of the students attending District schools; and

WHEREAS, to provide adequately for the District’s educational programs and operations, the Board of Directors of the District (the “Board”) deems it necessary to levy supplemental taxes upon all of the taxable property within the District in excess of the maximum annual tax levy permitted by law to be levied within the District without a vote of the electors, such supplemental levy to be made for three years commencing with certification in 2025 for collection in the school years 2025–2026 through 2028–2029, inclusive, as authorized by Article VII, Section 2 of the State Constitution and RCW 84.52.053, with such excess taxes to be deposited into the District’s General Fund, or a sub-fund thereof, and used to continue funding such educational programs and operations; and

WHEREAS, the Constitution and laws of the State require that the question of whether the District may levy such supplemental excess taxes be submitted to the qualified electors of the District for their approval or rejection; and

WHEREAS, the Board deems it necessary and advisable to place the proposition for such supplemental excess tax levies before the District’s voters at an election to be held within the District on November 4, 2025 (the “Proposition”);

NOW, THEREFORE, BE IT RESOLVED BY THE BOARD OF DIRECTORS OF BAINBRIDGE ISLAND SCHOOL DISTRICT NO. 303, KITSAP COUNTY, WASHINGTON, as follows:

Section 1. The Board hereby finds and declares that the best interests of the District’s students and other residents require submission to the District’s voters, for their approval or rejection, the Proposition of whether the District shall levy supplemental excess property taxes upon all of the taxable property within the District to provide funding for continued educational programs and operations of the District, including but not limited to, teaching, instructional support, school supplies, athletics and extracurricular activities, operational support and transportation.

Upon approval by the voters of the Proposition substantially in the form set forth below, the District may use the proceeds of said levies during the 2025–2026 through 2028–2029 school years to provide educational programs, enhancements and operations funding for the District and fund other eligible activities in accordance with the Basic Education Funding Act (Laws of 2017, 3d Spec. Sess., ch. 13), as amended and supplemented, and other applicable law.

Section 2. Upon approval by the voters of the Proposition, the District will levy the following taxes upon all of the taxable property within the District in excess of the maximum annual tax levy permitted by law to be levied within the District without a vote of the electors and supplementing the enrichment and operations levy approved by the District’s voters at the February 13, 2024 election, for deposit into the District’s General Fund:

A. $1,103,828, said levy to be made in 2025 for collection in 2026;

B. $1,572,896, said levy to be made in 2026 for collection in 2027; and

C. $2,002,902, said levy to be made in 2027 for collection in 2028.

The exact levy rate and the actual amounts collected for the supplemental levy shall be adjusted based upon (1) the actual assessed value of the property within the District at the time of the levy, and (2) the legal limit on the levy rate and levy amount applicable at the time of the levy. At this time, based upon information provided by the Kitsap County Assessor’s Office, the estimated supplemental levy rate is $0.08 per $1,000 of assessed value for the 2026 collection year, $0.11 per $1,000 of assessed value for the 2027 collection year, and $0.13 per $1,000 of assessed value for the 2028 collection year.

Section 3. The Board hereby requests that the Kitsap County Auditor, as ex officio supervisor of elections in Kitsap County, Washington (the “Auditor”), assume jurisdiction of, call, and conduct a special election to be held within the District on November 4, 2025, and submit to the qualified electors of the District the Proposition hereinafter set forth. The Auditor shall conduct the election by mail or as the Auditor otherwise requires.

The Board hereby authorizes and directs the Secretary of the Board (the “Secretary”) to certify the Proposition to the Auditor in the following form:

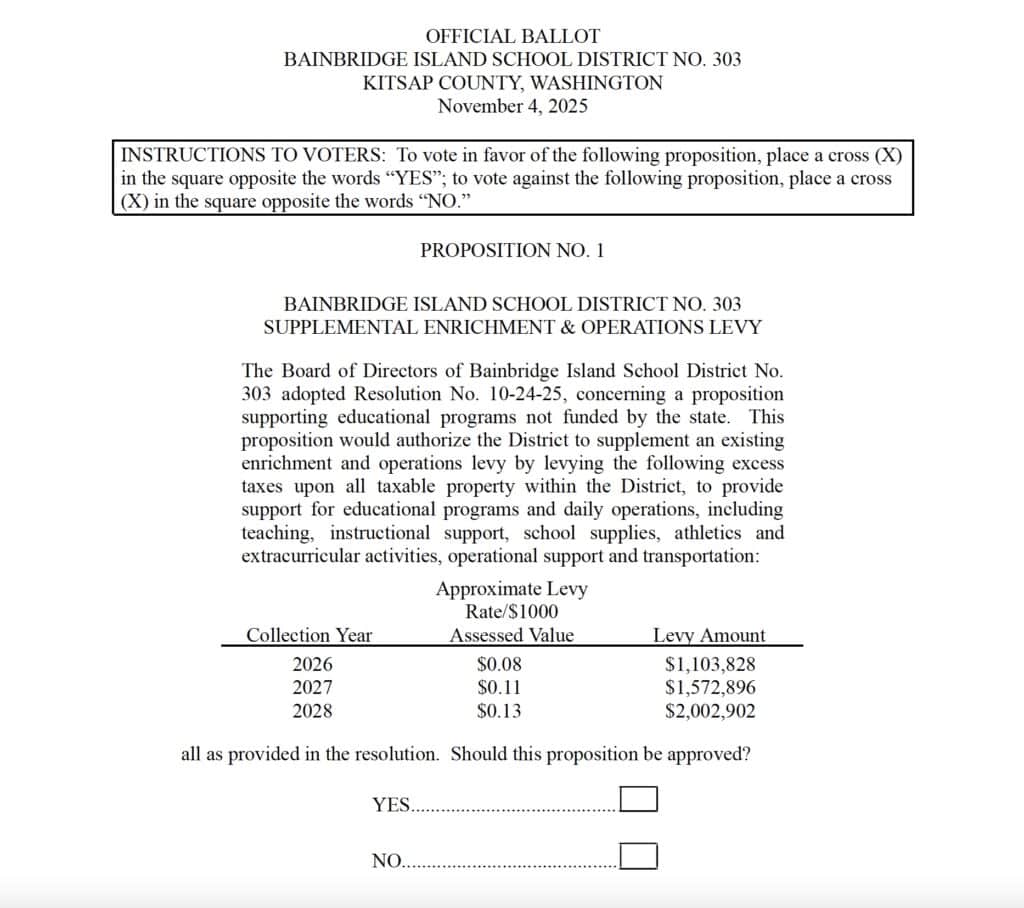

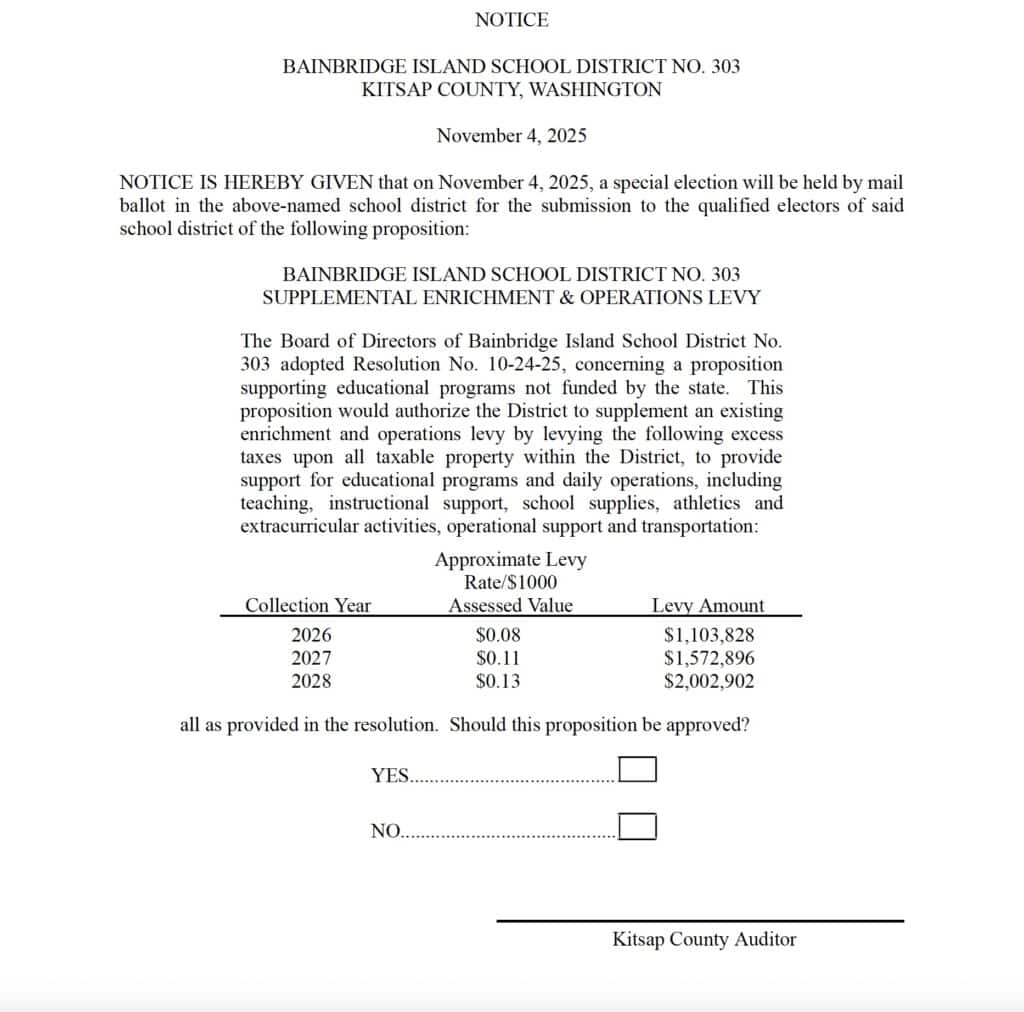

PROPOSITION NO. 1

BAINBRIDGE ISLAND SCHOOL DISTRICT NO. 303 SUPPLEMENTAL ENRICHMENT & OPERATIONS LEVY

The Board of Directors of Bainbridge Island School District No. 303 adopted Resolution No. 10-24-25, concerning a proposition supporting educational programs not funded by the state. This proposition would authorize the District to supplement an existing enrichment and operations levy by levying the following excess taxes upon all taxable property within the District, to provide support for educational programs and daily operations, including teaching, instructional support, school supplies, athletics and extracurricular activities, operational support and transportation:

Collection Years

Approximate Levy Rate per

$1,000 of Assessed Value

Levy Amount

2026

2027

2028

$0.08

$0.11

$0.13

$1,103,828

$1,572,896

$2,002,902

Should this proposition be approved?

YES ☐

NO ☐

The Board hereby directs the Secretary to deliver a certified copy of this resolution to the Auditor no later than August 5, 2025, and to perform such other duties as are necessary or required by law to submit the Proposition to voters.

Section 4. The Board hereby designates the following as the individuals to whom the Auditor shall provide notice of the exact language of the ballot title, as required by RCW 29A.36.080: (a) Chief Financial Officer (Kim Knight), telephone: (206) 780-1061, email: kmknight@bisd303.org; and (b) the District’s Bond Counsel, Pacifica Law Group LLP (Faith Pettis), telephone: (206) 245-1700, email: faith.pettis@pacificalawgroup.com. The Board authorizes the Secretary to approve changes to the ballot title, if any, as the Auditor or the Kitsap County Prosecuting Attorney deems necessary.

Section 5. The Board authorizes and directs the President of the Board, the Secretary, and the District’s Chief Financial Officer to take such actions and to execute such documents as in their judgment may be necessary or desirable to effectuate the provisions of this resolution, and to perform such other duties as are necessary or required by law to submit to the District’s voters at the aforesaid special election, for their approval or rejection, the Proposition of whether the District shall levy supplemental annual excess property taxes to pay costs of District educational programs and services. The Board hereby ratifies and confirms all actions of the District or its staff or officers taken prior to the effective date of this resolution and consistent with the objectives and terms of this resolution.

Section 6. In the event that any provision of this resolution shall be held to be invalid, such invalidity shall not affect or invalidate any other provision of this resolution, but shall be construed and enforced as if such invalid provision had not been contained herein; provided, however, that any provision which shall for any reason be held to be invalid shall be deemed to be in effect to the extent permitted by law.

Section 7. This resolution shall become effective immediately upon its adoption.

ADOPTED by the Board of Directors of Bainbridge Island School District No. 303, Kitsap County, Washington, at a regular meeting thereof, held on the 31st day of July, 2025.

BAINBRIDGE ISLAND SCHOOL DISTRICT

NO. 303, KITSAP COUNTY, WASHINGTON

__________________________________________________

President and Director

__________________________________________________

Director

__________________________________________________

Director

__________________________________________________

Director

__________________________________________________

Director

ATTEST

________________________________________________

Secretary, Board of Directors

CERTIFICATE

I, the undersigned, Secretary of the Board of Directors of Bainbridge Island School District No. 303, Kitsap County, Washington, (the “District”) and keeper of the records of the Board of Directors (the “Board”), DO HEREBY CERTIFY:

1. That the attached resolution is a true and correct copy of Resolution No. 10-24-25 of the Board (the “Resolution”), duly adopted at a regular meeting thereof held on the 31st day of July, 2025.

2. That said meeting was duly convened and held in all respects in accordance with law, and to the extent required by law, due and proper notice of such meeting was given; that a legal quorum was present throughout the meeting and a legally sufficient number of members of the Board voted in the proper manner for the adoption of the Resolution; that all other requirements and proceedings incident to the proper adoption of the Resolution have been duly fulfilled, carried out and otherwise observed; and that I am authorized to execute this certificate.

IN WITNESS WHEREOF, I have hereunto set my hand 31st day of July, 2025.

________________________________________________

Secretary, Board of Directors