Our Schools. Our Future. Vote YES on February 13, 2024

Financial Impact FAQ's

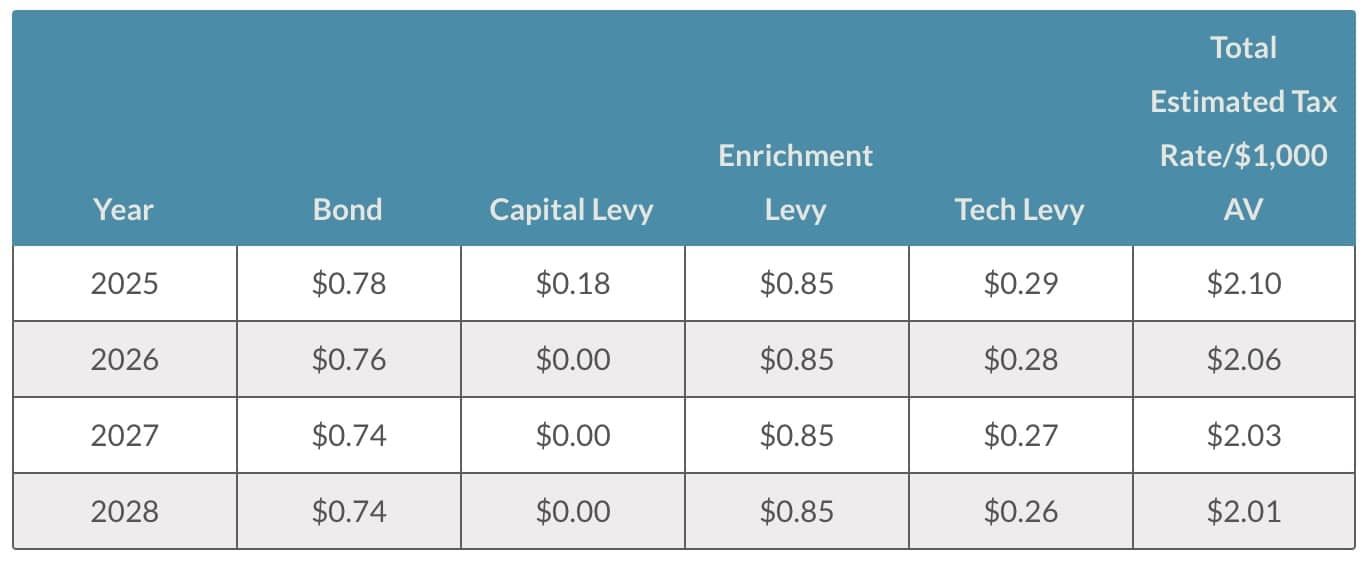

Estimated tax rate per $1000 assessed value.

Tax rates assume a 1% annual growth rate in assessed valuation for the district.

Estimated tax rate per $1000 assessed value.

*For comparison, the total local school tax rate in 2021 = $2.62, 2022 + $2.48, 2023 = $2.04

If the E&O levy passes, the average* homeowner will pay about $105 (or ~$8.79/month) more a year for the Enrichment & Operations Levy.

*based on 2023 Median Assessed Home Value increasing an average of 3% a year

If the Tech levy passes, the average* homeowner will pay about $124 (or ~$10.35/month) more a year for the Tech Levy.

*based on 2023 Median Assessed Home Value increasing an average of 3% a year

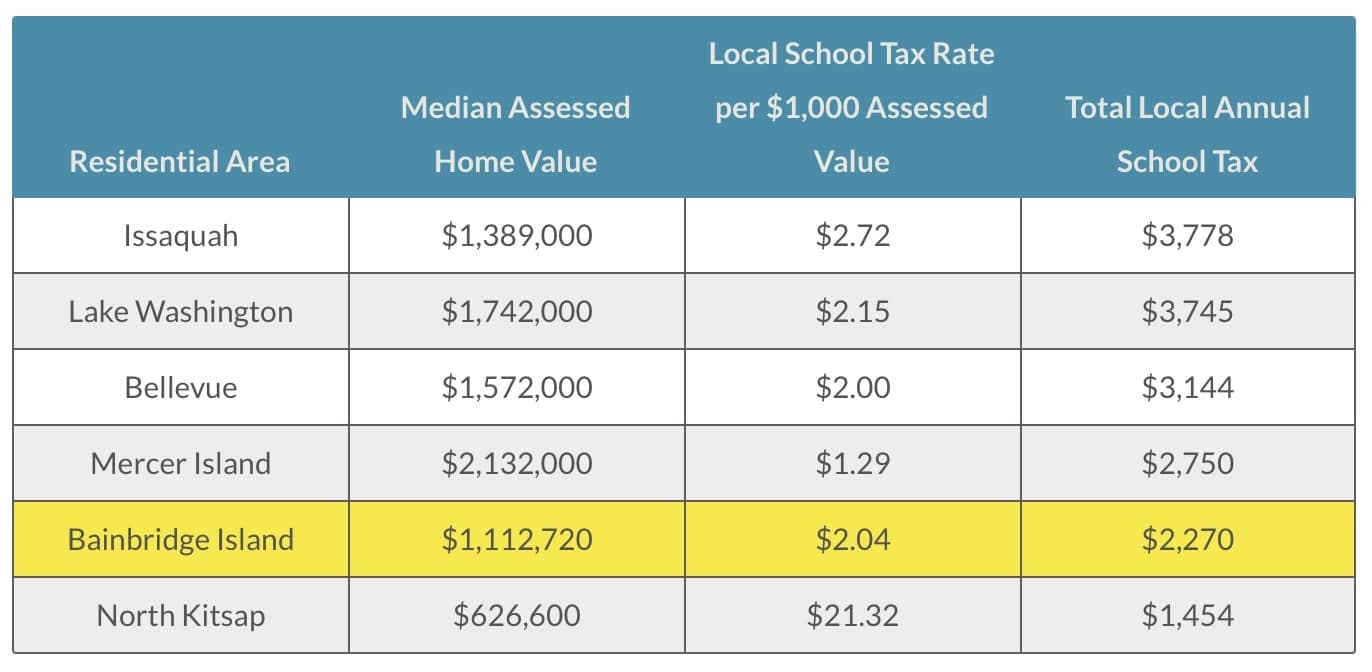

Here’s a look at what some comparable communities paid in 2023.

So, we’re higher than our neighbor across the bridge, but lower than other districts across the water with whom we like to compare ourselves.

Not necessarily. First, taxes are calculated on the assessed value of your home, not the appraised value. Assessed values don’t fluctuate as wildly year-to-year. Second, the district asks the community for a total amount, and your portion of that amount will fluctuate based on the number of homes paying and on the value of your home relative to other homes in the community. It’s like a pie that’s being divided up among everyone in the community. If more homes are built, the pie will be cut into more pieces, and your slice will be smaller. It is important to note that the pie will never get bigger, but the size of your slice may change in value relative to others.

Not always. When the legislature enacted the “McCleary fix” they set limits on how much local districts could collect for enrichment levies. The limit is the lesser of either $2.50 per $1000 AV or $2,988 per student. BISD qualifies for the latter and only collects $2,988 per student. As enrollment fluctuates, so does the amount the district can collect. For example, though voters approved an enrichment levy amount of $11 M in 2021, BISD will be collecting $9,830,165.

The amount requested is the maximum that can be collected. It can never be more, and it could be less.

You can find them using the menu at the top of this site.

The Kitsap County Auditor will mail ballots to voters in late January (approximately Jan 26, 2024). Completed ballots must be either:

1. Dropped at a polling location before 8 pm on February 13, 2024 or;

2. Returned by mail in the postage-paid, supplied envelope postmarked by February 13.

Please note that a stamp is NOT required.

The deadline to register to vote is 8 days before an election. In this case, February 5, 2024.

For more information on registering to vote in Kitsap County go here.